Retail margins could be boosting man-made diamond sales

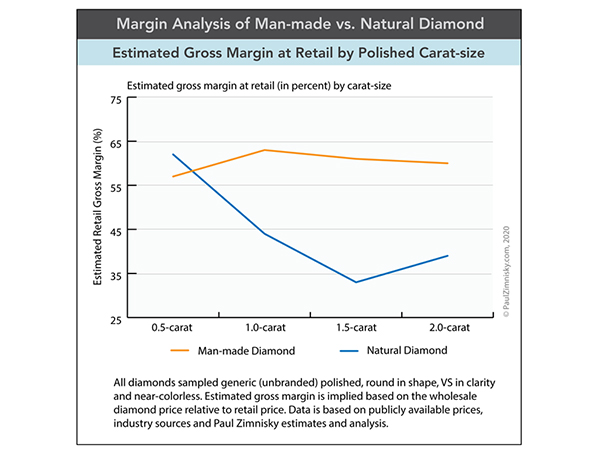

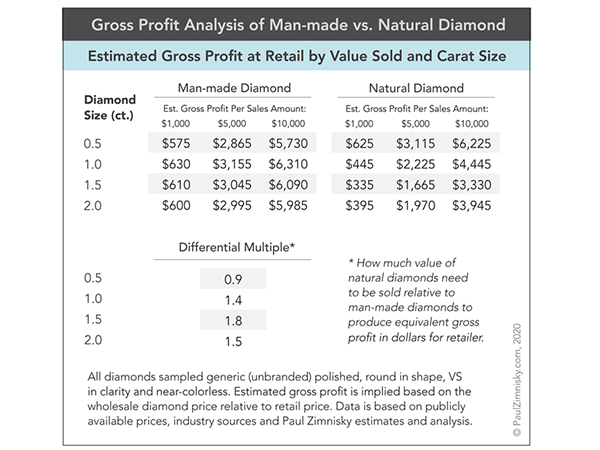

When analyzing the wholesale and retail prices of unbranded man-made and natural diamonds, it appears that the retail gross margin of man-made diamonds in popular carat-sizes is as much as 1.8-times that of natural diamonds (see below figures).

To further quantify this, for example, in some cases a retailer would theoretically only have to sell $5,000 worth of man-made diamonds to generate the same gross profit as selling almost $10,000 worth of equivalent natural diamonds. Here, “gross margin” is considered to be a retailer’s top-line profit when selling a diamond, i.e. the sales price relative to the wholesale cost of the diamond.

This is important metric for a retailer selling both man-made and natural diamonds because the theoretical high gross profit margin of man-made diamonds serves as an implied incentivize to prioritize selling man-made diamonds over natural –as long as the profit margin differential remains in place. Further, given that retailers are the direct point of contact between a consumer and a diamond, retailers may be more inclined to promote the beneficial attributes of a man-made stone over a natural, thereby influencing a customer’s longer-term perception of the products.

Despite the significant growth in the availability of man-made diamond jewelry in recent years, it is estimated that still only 1 in 5 diamond retailers in the U.S. carry man-made diamonds; and outside of the U.S. the figure is even (much) smaller.

Further, many of the jewelers and other retailers that do carry man-made diamonds only have limited inventory as customer appetite for the product is tested. This has perhaps allowed the few retailers that do carry man-made diamonds, especially those that are more fully stocked, to charge premiums.

Further, given the relatively lower-production costs of man-made diamonds compared to that of natural (especially notable in larger carat-sizes given that man-made diamonds are a manufactured good), it is theoretically more affordable for the supply chain to offer man-made diamonds to retailers on memo (i.e. consignment). With goods on consignment, retailers typically have lower, or zero, inventory capital costs and can therefore be more selective in offering discounts to the consumer, perhaps resulting in more resilient profit margins.

However, going forward, as the man-made diamond jewelry complex matures, as new producers and better production technology increases supply and as more retailers compete downstream, especially those selling unbranded goods, the product will likely become more commoditized. Resultantly, retail margins could erode and eventually fall to within that of natural diamonds or even lower.